“REALTORS, PREVENT WIRE FRAUD AND LEGAL ACTION”

Wire fraud trends are constantly changing. As a real estate agent, there are ways to protect your clients and yourself in a real estate transaction when handling earnest money and closing funds via wire transfer. Newest trends show that the fraudsters are contacting the consumer at the beginning of the transaction in order to convince them to send funds

early, quite often via an agent’s hacked Gmail/Yahoo/AOL email account. In terms of security, not all email programs/platforms are created equal!

To minimize the risk of wire fraud, all real estate agents should use a paid service and not a free email platform like Gmail. Zoho Mail, for example, can help you establish a secure email address and a unique email domain, which is also ideal for branding. For agents who would like to continue using Gmail or Yahoo, it is imperative to focus on good, unique

passwords and regularly changing that password. Email is the easiest avenue for a potential fraudster to contact the consumer pretending to be YOU, therefore your communication to the consumer at the beginning of the transaction is KEY to ensuring the funds will be wired to the correct party for your closing.

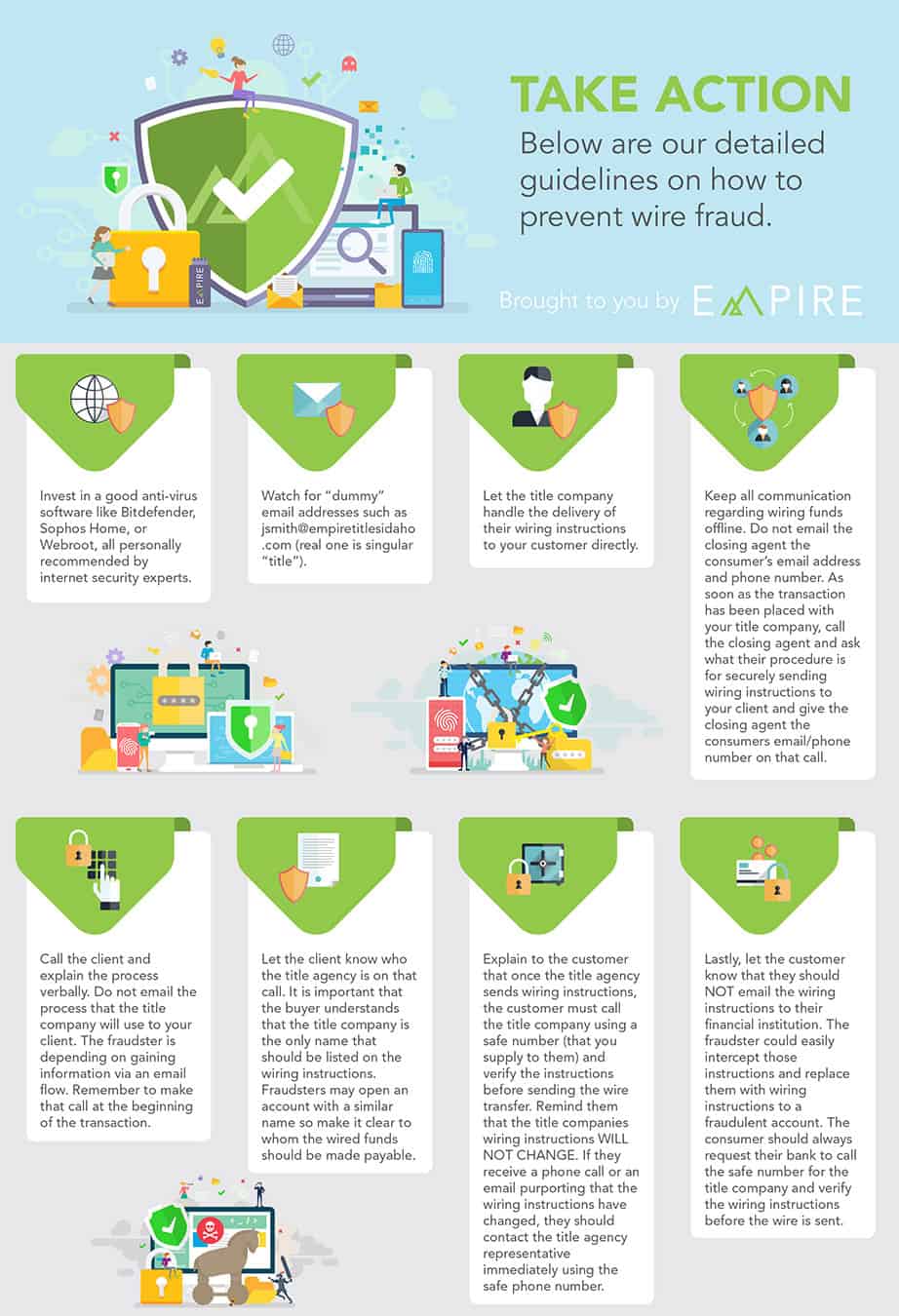

TAKE ACTION- Below are our detailed guidelines on how to prevent wire fraud:

- Invest in a good anti-virus software like Bitdefender, Sophos Home, or Webroot, all personally recommended by internet security experts.

- Watch for “dummy” email addresses such as jsmith@empiretitlesidaho.com (real one is singular “title”).

- Let the title company handle the delivery of their wiring instructions to your customer directly.

- Keep all communication regarding wiring funds offline. Do not email the closing agent the consumer’s email address and phone number. As soon as the transaction has been placed with your title company, call the closing agent and ask what their procedure is for securely sending wiring instructions to your client and give the closing agent the consumers email/phone number on that call.

- Call the client and explain the process verbally. Do not email the process that the title company will use to your client. The fraudster is depending on gaining information via an email flow. Remember to make that call at the beginning of the transaction.

- Let the client know who the title agency is on that call. It is important that the buyer understands that the title company is the only name that should be listed on the wiring instructions. Fraudsters may open an account with a similar name so make it clear to whom the wired funds should be made payable.

- Explain to the customer that once the title agency sends wiring instructions, the customer must call the title company using a safe number (that you supply to them) and verify the instructions before sending the wire transfer. Remind them that the title companies wiring instructions WILL NOT CHANGE. If they receive a phone call or an email purporting that the wiring instructions have changed, they should contact the title agency representative immediately using the safe phone number.

- Lastly, let the customer know that they should NOT email the wiring instructions to their financial institution. The fraudster could easily intercept those instructions and replace them with wiring instructions to a fraudulent account. The consumer should always request their bank to call the safe number for the title company and verify the wiring instructions before the wire is sent.

We can all do our part to minimize the risks of wire fraud and keep our clients (and their hard-earned funds) safe from adaptable and innovative fraudsters. Remind your clients to carefully check all email addresses throughout the process for subtle typos that can easily identify a potential fraudster attempting to poach an email thread and redirect funds. And if anything at all seems off to you, never hesitate to take those 5 minutes to call and double-check; this is one instance in which it is always better to be safe than sorry.